题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

investment()

A.投资

B.环境

C.登录

D.选项

答案

答案

A、投资

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码下载APP

拍照、语音搜题,请扫码下载APP

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.投资

B.环境

C.登录

D.选项

答案

答案

A、投资

更多“investment()”相关的问题

更多“investment()”相关的问题

第2题

如果一个小型开放经济禁止进口日本VCRS,则储蓄、投资、贸易余额、利率以及汇率会发生什么变动?

If a small open economy bans the import of Japanese VCRs, what happens to saving, investment, the trade balance, the interest rate, and the exchange rate?

第3题

用IS-LM图描述下列变动对国民收入、利率、物价水平、消费、投资以及实际货币余额的短期与长期影响。

a.货币供给增加。

b.政府购买增加。

c.税收增加。

Use the IS-LM diagram to describe the short-run and long-run effects of the following changes on national income, the interest rate, the price level, consumption, investment, and real money balances.

a.An increase in the money supply.

b.An increase in government purchases.

c.An increase in taxes.

第4题

数向上移动。这种移动如何影响投资和利率?

Suppose that all increase in consumer confidence raises consumers' expectations of future income and thus the amount they want to consume today. This might be interpreted as an upward shift in the consumption function. How does this shift affect investment and the interest rate?

第5题

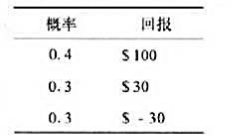

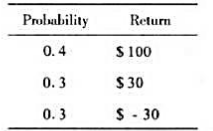

假设一位投资者关心的某项商业项目可能有三个前景——其概率与回报如下表所示。

这项不确定性投资的期望收益、方差各是多少?

Suppose an investor is concerned about a business choice in which there are three prospects -the probability and returns are given below:

What is the expected value of the uncertain investment? What is the variance?

第6题

在凯恩斯交叉图中,假设消费函数如下:

C=200+0.75(Y-T)

计划投资是100;政府购买和税收都是100。

a.画出作为收入的函数的计划支出。

b.均衡的收入水平是多少?

c.如果政府购买增加到125,新的均衡收入是多少?

d.为了达到1600美元的收入。需要的政府购买水平是多少?

In the Keynesian cross, assume that the consumption function is given by

C=200+0.75(Y-T)

Planned investment is 100; government purchases and taxes are both 100.

a.Graph planned expenditure as a function of income.

b.What is the equilibrium level of income?

c.If government purchases increase to 125, what is the new equilibrium income?

d.What level of government purchases is needed to achieve an income of 1,600?

第7题

下面的问题详细地分析教材中介绍的两部门内生增长模型。

a.用效率工人的人均产出和效率工人的人均资本重新求出制成品的生产函数。

b.在这个经济中,收支相抵的投资(保持效率工人人均资本量不变所需要的投资量)是多少?

c.求出k变动的公式,该公式表示△k是储蓄减收支相抵的投资。用这个式子画出一个表示稳定状态k的决定的图形。(提示:这个图看起来很像我们在分析索洛模型时所用过的图。)

d.在这个经济中,稳定状态的人均产出Y/L增长率是多少?储蓄率s和在大学中的劳动力比例u如何影响这一稳定状态增长率?

e.用你的图说明u的提高的影响。(提示:这种变动对两条曲线都产生影响。)

f.根据你的分析,u的提高对经济肯定是一件好事吗?并解释。

This question asks you to analyze in more detail the two-sector endogenous growth model presented in the text.

a.Rewrite the production function for manufactured goods in terms of output per effective worker and capital per effective worker.

b.In this economy, what is break-even investment (the amount of investment needed to keep capital per effective worker constant)?

c.Write down the equation of motion for k. which shows △k as saving minus break-even investment, Use this equation to draw a graph showing the determination of steady-state k. (Hint: This graph will look much like those we used to analyze the Solow model.)

d.In this economy, what is the steady-state growth rate of output per worker Y/L? How do the saving rate s and the fraction of the labor force in universities u affect this steadystate growth rate?

e.Using your graph, show the impact of an increase in u. (Hint: This change affects both curves.) Describe both the immediate and the steady-state effects.

f.Based on your analysis, is an increase in u an unambiguously good thing for the economy? Explain.

第8题

The term investment portfolio (证卷投资组合) conjures up visions of the truly rich--the Rockefellers, the WalMart Waltons, Bill Gates. But today, everyone--from the Philadelphia firefighter, his part-time receptionist wife and their three children, to the single Los Angeles lawyer, starting out on his own--needs a portfolio.

A portfolio is simply a collection of financial assets, it may include real estate, rare stamps and coins, precious metals and even artworks. But those are for people with expertise. What most of us need to know about arc stocks, bonds and cash (including such cash equivalents as money market funds).

How do you decide what part of your portfolio should go to each of the big three? Begin by urulerstanding that stocks pay higher returns but are more risky; bonds and cash pay lower returns but are less risky.

Reach by Ibbotson Associates, for example, shows that large company stocks, on average, have returned 11.2 percent annually since 1926. Over the same period, by comparison, bonds have returned an annual average of 5.3 percent and cash, 3.8 percent.

But short term risk is another matter. In 1974, a one-year $1000 investment in the stock market would have declined to $735.

With bonds, there are two kinds of risk: that the borrower won't pay you back and that the money you'll get won't be worth very much. The U.S. government stands behind treasury bonds, so the credit risk is almost nil. But the inflation risk remains. Say you buy a $1000 bond maturing in ten years. If inflation averages about seven percent over that time, then the$1000 you receive at maturity can only buy $500 worth of today's goods.

With cash, the inflation risk is lower, since over a long period you can keep rolling over your CDs every year (or more often). If inflation rises, interest rates rise to compensate.

As a result, the single most important rule in building a portfolio is this: If you don't need the money for a long time, then put it into stocks. If you need it soon, put it into bonds and cash.

This passage is intended to give 'advice on______.

A.how to avoid inflation risks

B.what kinds of bonds to buy

C.how to get rich by investing in stock market

D.how to become richer by spreading the risk

第9题

第10题

Choose two countries that interest you——one rich and one poor. What is the income per person in each country? Find some data on country characteristics that might help explain the difference in income: investment rates, population growth rates, educational attainment, and so on. (Hint: The Web site of the World Bank,www.worldbank.org,is one place to find such data.) How might you figure out which of these factors is most responsible for the observed income difference?

第11题

下,美国的储蓄、投资、贸易余额、利率以及汇率会发生什么变动?(为了使事情简单化,分别考察下面每一种影响。)

a.美国政府由于担心自己需要介入战争,增加了对军事装备的购买。

b.其他国家增加了对高技术武器的需求,这是美国的主要出口。

c.战争使美国企业对未来无法确定.而且,企业的一些投资项目被延期。

d.战争使美国消费者对未来无法确定,而且做出的反应是储蓄更多。

e.美国人变得害怕出国旅行,因此更多的人在美国度假。

f.外国投资者在美国为他们的投资组合寻找一个避风港。

If a war broke out abroad, it would affect the U.S. economy in many ways, Use the model of the large open economy to examine each of the following effects of such a war. What happens in the United States to saving, investment, the trade balance, the interest rate, and the exchange rate? (To keep things simple, consider each of the following effects separately.)

a.The U.S. government, fearing it may need to enter the war, increases its purchases of military equipment.

b.Other countries raise their demand for high-tech weapons, a major export of the United States.

e.The war makes U.S. firms uncertain about the future, and the firms delay some investment projects.

d.The war makes U.S. consumers uncertain about the future, and the consumers save more in response.

e.Americans become apprehensive about traveling abroad, so more of them spend their vacations in the United States.

f.Foreign investors seek a safe haven for their portfolios in the United States.